New data shows that businesses across London have received a total of almost £9bn in funding under the government’s two largest Covid-19 loan schemes, the Coronavirus Business Interruption Loan Scheme (CBILS) and the Bounce Back Loan Scheme (BBL). These provide financial support to businesses across the UK that are losing revenue, and seeing their cashflow disrupted, as a result of the Covid-19 outbreak:

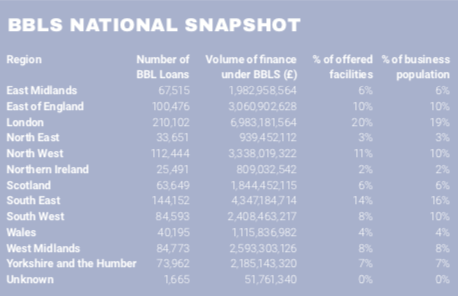

- over 210,000 loans worth almost £7bn have been offered across London under the BBLS, which provides a six-year term loan from £2,000 up to 25% of a business’ turnover, with a limit of £50,000.

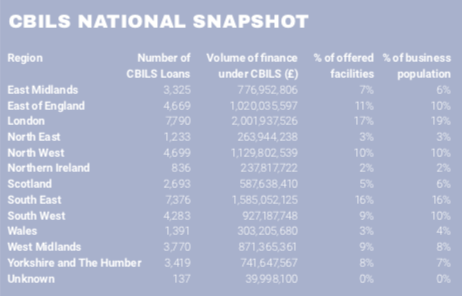

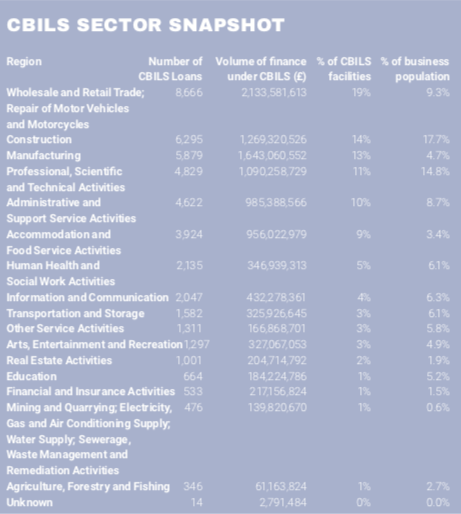

- over 7,700 loans worth over £2bn have been offered across London under the CBILS, which provides Business loans, overdrafts, invoice finance and asset finance of up to £5m to businesses with a turnover less than £45m.

Total funding provided to London businesses represents 20% of the national total, in line with the relative size of London’s business population (19%).

Keith Morgan, Chief Executive Officer of the British Business Bank:

“A key objective for the British Business Bank is to identify and help reduce regional imbalances in access to finance for smaller businesses across the UK. It is welcome to see in the data that these schemes are helping businesses in London to access the finance they need to survive and stabilise, putting them in a better position to grow as we move into recovery.”

The British Business Bank is the UK government’s economic development bank. Established in November 2014, its mission is to make finance markets for smaller businesses work more effectively, enabling those businesses to prosper, grow and build UK economic activity. Its remit is to design, deliver and efficiently manage UK-wide smaller business access to finance programmes for the UK government.

The British Business Bank Finance Hub provides independent and impartial information to high-growth businesses about their finance options, featuring short films, expert guides, checklists and articles from finance providers to help make their application a success. The site also features case studies and lessons from real businesses to guide businesses through the process of applying for growth finance.

Note: Regional and sectoral Coronavirus Large Business Interruption Scheme data has not been included in this analysis due to data protection and commercial considerations. Data on CBILS and BBLS schemes drawn from the British Business Bank loans portal, August 2nd 2020.