Whether you invest for income, savings or capital growth, the last 20 years have been dominated by uncertainty and dramatic changes to investment markets.

Many investors have failed to generate decent returns on their money, and face even more difficulties in choosing what to do now.

Falling (and failing) investments for 20 years!

Investment in shares has been the mainstay of many investment portfolios for around 100 years. But consider the performance of the FTSE 100 index, which measured approx. 7,000 at the turn of the millennium. On April 1st 2020, it stood at 5,500, a loss of 22% over 20 years.

This is a massive underperformance by anyone’s standards and a serious blow to millions of investors!

Government Gilts and Savings Accounts

Most investors have also held income producing assets, particularly for retirement or to supplement other sources.

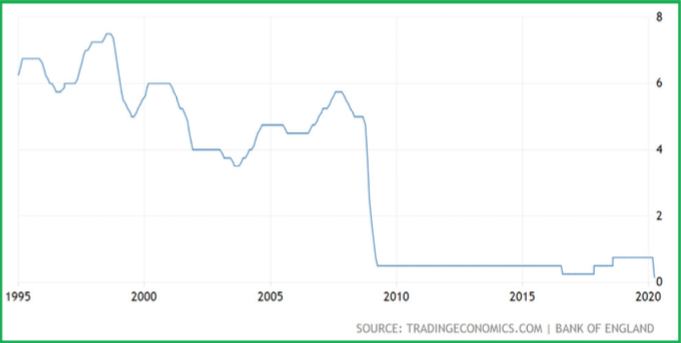

Investment income primarily depends on interest rates. We now have the lowest bank base rate ever (for more than 300 years!) at just 0.10% pa.

The impact of this incredible fall in bank base rate has been calamitous. It has effectively wiped any income from millions of investor portfolios invested in Gilts or bank and savings accounts.

Buy-To-Let (BTL) Property

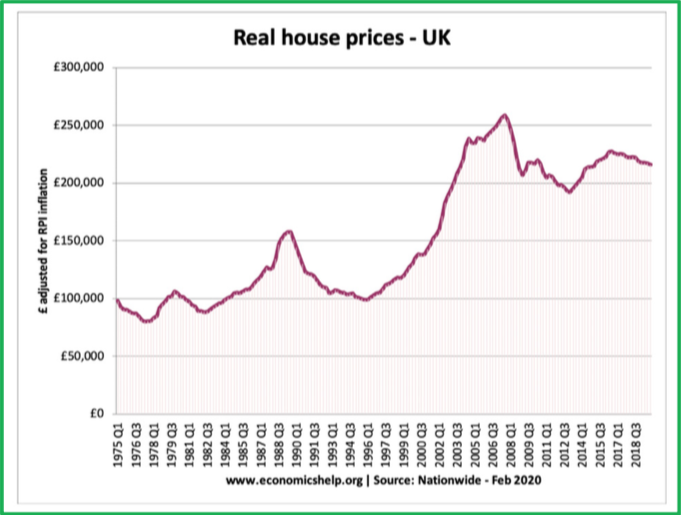

Many investors, in recent years, have chosen to invest in property and receive rental income. Sadly, BTL property no longer offers the same profitability. Review the Nationwide index of house prices across 40 years;

Over the period from 1975 to 2018, a period of 43 years, property has delivered an average capital growth from £100,000 to £220,000, a rate of 1.85% a year. Very disappointing.

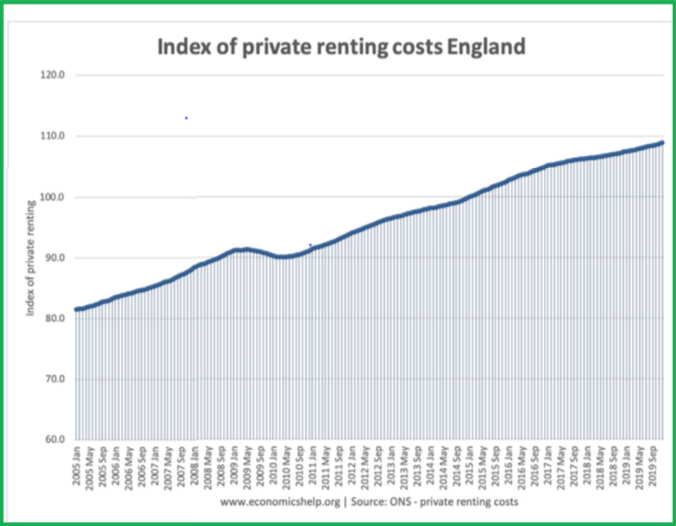

Not only is capital growth questionable, the costs of owning and running buy-to-let property have also escalated, significantly reducing the net rental yield.

This chart shows a rise of 38% in private renting costs since 2005, which has impacted all landlords.

The Big Challenge

So what can you do to generate income where every major asset class has failed to deliver, broadly for 20 years? These Seven Principles may show the path.

Principle No 1: Forget the "same old, same old"

Have you heard the saying; ‘If you keep doing what you’ve always done, you’ll keep getting what you’ve always got.’ What you have now needs real improvement!

Look outside the box and consider new investment options. Mainstream investments have mostly failed to deliver for twenty years! How long does something have to fail before you say ‘enough is enough’.

Principle No 2: Fixed is better than variable

In a time of uncertainty, fixed income beats variable income every time.

If you are seeking income to live on now, or to build up your savings for the future, then knowing – in advance – what you will receive and when you will receive it is crucial.

At Avantis Wealth we are massive believers in investors being assured of what they will receive in return for investment – fixed income with a fixed payment schedule, whether monthly, quarterly, six-monthly or annually.

Principle No 3: Insist on Rewarding Returns

What do you consider to be a reasonable return on your investment money? Most investors anticipate a very low return in the range of 1% - 3% annually.

At Avantis Wealth our focus is on investments that offer from 7% to 15% annually. Investors are often surprised that this level of return can be achieved at modest risk.

We believe that rewarding returns are absolutely essential for everyone who invests.

Principle No 4: Short-term is better than long-term

The longer the term of investment, the greater the risk. Who knows what will happen in any sector or with any company over the next 5-10 years? It’s difficult enough to have any confidence in the next 12 months. So our focus is on short term investments typically over 12-36 months, but still providing rewarding returns. It’s a powerful combination!

Principle No 5: Diversification offers real benefits

In my opinion, the most important time to have a diversified portfolio is in uncertain times where the economic outlook is poor.

Diversification means holding a variety of assets in your portfolio. If you hold one investment and it fails, you could lose 100% of your money. But if you held more, the chance of them all going bust at the same time is small, assuming they are diversified. Therefore, the level of risk is much reduced.

Principle No 6: Underpin your investment with security

We are great believers in bringing security to all investments. Security is a positive addition but rarely offers perfect protection.

Here are key points about the provision of ‘security’.

- Any security is better than no security

- A first legal charge over property is the best available option.

- There are many security options: First legal charge, second legal charge, personal guarantee, corporate guarantee, debenture, charge over other assets etc.

- The lower the quality of security, the higher the investment return that is required.

- For many investments, including the bulk of regulated investments like shares, there is no security at all!

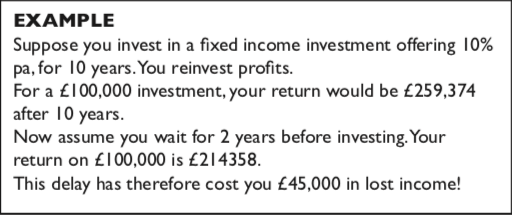

Principle No 7: Waiting costs you money

When there are significant shifts in the marketplace, and shocks to the system, investors are naturally concerned, often choosing to ‘sit and wait’ before investing.

Recent market uncertainty has been driven by the dot.com crash in 2000 and 2001, the housing crash followed by the financial crash in 2008-2009 and now the coronavirus pandemic of 2020.

Sitting and waiting appears to be a low risk strategy. However, being out of the market carries a significant cost, viz;

I suggest you explore ways to protect yourself from the vagaries of the market. My recommendation is to consider fixed income, short-term investments with rewarding returns.

Bringing it all together

The Seven Principles offers a new approach to investment, intended to delivery better returns.

Think about the value of these Principles for your own investments and adopt the ones that you believe will add value to your strategy.

Remember that nothing is certain in investing. Capital is almost always at risk and you may get back less than you invested, or in a worst case lose all the capital invested. I recommend that you take advice from a regulated advisor before changing your investment strategy.

If you would like to explore investment opportunities which match the Seven Principles, without cost or obligation, just email invest@avantiswealth.com , call +44 1273 447299 (UK office hours), or visit our website at www.avantiswealth.com.