After starting out with the NatWest Graduate scheme, followed by a decade working for Dutch banks, Stuart found himself back at RBS ten years ago after the group acquired ABN AMRO, the bank where he was working at the time. The purchase of ABN AMRO wasn’t the best decision RBS ever made, but for Stuart it offered a new career path, culminating in his recent appointment where he now looks after the bank’s business customers across London and the South East who turnover more than £2m a year.

Responsible for a team of approximately 300 across London, Kent, Sussex and Surrey, Stuart’s core purpose is simple. How can the bank help their business customers be more successful? How can the bank help them grow?

“Our core proposition is obviously the provision of funding and banking services but around that we provide so much more,” says Stuart. “Sometimes that’s acting as a sounding board. Many of our relationship managers are considered to be trusted business partners, particularly for some of our smaller businesses.

“Sometimes it’s about helping businesses find new suppliers, new customers, staff, professional advisors, or even a new commercial premises to support their expansion. It’s about using our networks.

“If our customers grow then that supports the local economy, it creates employment and it also creates business opportunity for us. We have around a quarter of the market, which means we play a very important part in supporting the economy in this region.”

The market share in the business sector is very impressive, but there is no room for complacency with increased competition.

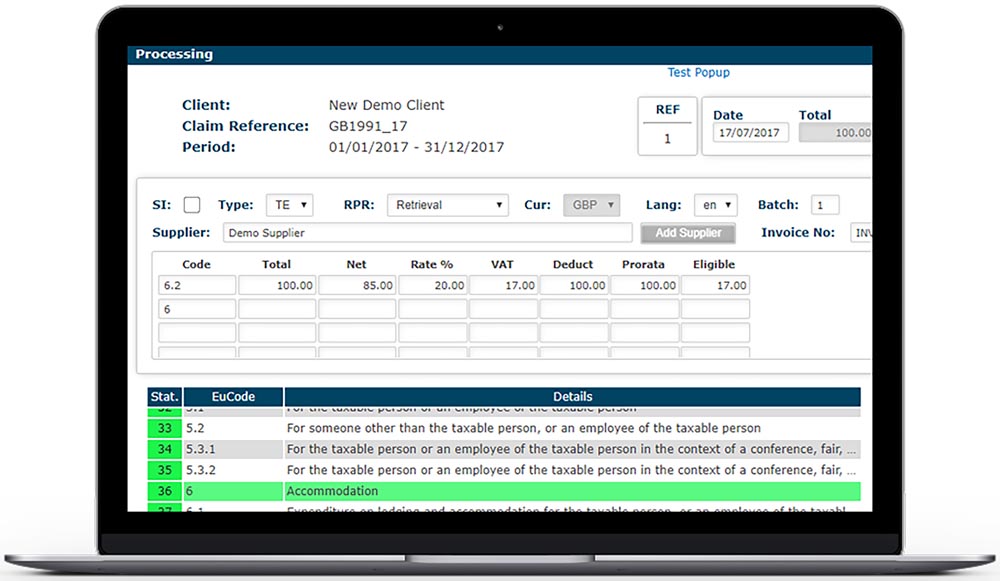

“We already have a very competitive banking sector in this country and the level of competition is increasing,” says Stuart. “Some of the new challengers are pursuing a digital-only offering, others offer a traditional face-to-face approach. Whatever business model they choose, increased competition is ultimately good for the customer – it gives them more choice and it means that we have to constantly up our game in terms of the products and services that we offer and the customer experience that we wrap around them. But if we get it right we can offer the best of both worlds; the combination of smart technology with a face-to-face presence.

“We have a strong face-to-face proposition through our network of relationship managers – people who are plugged into the local ecosystem. We can combine the benefits of being part of those local communities, with the specialist knowledge and expertise that comes from our national presence. Added to this is a set of digital solutions that allow customers to see to their everyday banking needs when and where they want to.”

As the nature of banking changes with the digital revolution, Stuart is passionate about embracing new technologies and he is keen to keep abreast of new ideas.

“I was in San Francisco recently for a summit run by Singularity University whose purpose is to help leaders understand exponential technology and help them think about how it can be used to make the world a better place. One of the key takeaways for me was to recognise that the world is changing faster than any of us appreciate – the future is here already, it’s just not evenly distributed.

“We have a role to play, amongst others, to help educate businesses and stimulate their thinking - for example by asking “What might 3D printing, robotics, artificial intelligence or blockchain do to your business or your industry? Are you looking at it? If not, how can we help you begin that journey? It is important that we continually raise awareness and help customers on their journey to understand and embrace innovation and exponential technology.

“At the bank we’re actively using quantum computing, blockchain and artificial intelligence; we’re piloting an avatar that our retail customers are going to be able to interact with.

“Every business and every industry will be disrupted by technology. We just don’t know exactly how. So this need to be thinking ahead and to be agile is going to be important. We can bring customers together who are facing the same challenges or opportunities with technology. It’s almost an obligation for us to help in that space. We can help you find information, meet technology providers or some of the businesses who are pioneering in this space or speak with research scientists to co-develop solutions specific to your business.”

Inevitably, the B word crops up in our conversation. Brexit uncertainty is a concern for businesses according to Johnstone:

“Our recent mid-market business survey conducted together with Warwick Business School (insert link) underlines just how important exporting is to businesses – especially in the South East, where more than 80% of businesses export in some way, shape or form, and the vast majority of these export into the EU. So when you ask customers what’s on their mind and what they’re worried about, Brexit tends to come towards the top of the list.

“Economic indicators would suggest that there is some slowing down of activity because we’re now entering this period where it’s not entirely clear what the rules of the game will be and what exactly the deal will be. It’s very difficult to know exactly what the final form of Brexit is going to look like. Uncertainty is not helpful and human nature is such that people are therefore a little bit more cautious than they otherwise would be.”

Whatever happens the bank is well-placed to deal with shocks to the economy having significantly increased the amount of capital and liquidity that it holds. It wasn’t always the case and the 10-year anniversary of the financial crisis is a good moment to reflect on just how far the bank has come in that time

“I’ve seen at close hand how the bank has rehabilitated itself over the last 10 years. Despite the challenge of dealing with some pretty large legacy issues I am incredibly proud of how we have stayed focused on serving our customers through that period, and we have of course been rewarded in turn with fantastic loyalty from our customers which I hugely appreciate. Now all of our main legacy issues have been resolved, we have a very strong business that is doing some great things for customers and I know that we will continue to do even more going forward.