From January 13th 2018, personal tax payers were no longer able to use their credit cards to pay their tax bills. It’s the bitter sweet result of a Government decision to stop exorbitant fees being levied by businesses and Government bodies when people pay their bills by credit card.

The idea that backfired

The irony is that the original idea behind putting a stop to credit card charges was actually to help consumers by allowing them to pay their bills in this way free of charge. But, as HM Revenue and Customs would still have to pay what the bank charges for credit card payments, they would inevitably have to recoup the fees from public money. From HMRC’s point of view, it seems unfair that taxpayers would have to pick up the bill.

The payment methods you can still use

For the tax payer, who may not be aware that the ability to pay by credit card is about to disappear, it’s a double edged sword. People, who face difficulty settling their tax liability in one-go, will have to find alternative ways of spreading the cost over a period of time. This has led to criticisms from consumer groups who have branded HMRC “un-consumer” friendly by potentially forcing to people to take out loans. That’s if they can’t use the other recommended payment methods, namely debit cards, Direct Debit, Faster Payment and BACs.

It doesn’t apply to corporation tax

As an aside, it’s worth noting, that these new rules don’t apply to corporation tax which you will still be able to pay with a company credit card. You can’t use a number of different company credit cards to pay the same liability, but you could use another credit card to pay a different type of tax for example employer’s PAYE, if you need to. HMRC suggest allowing three days for the payment to reach their bank account and not to forget to include the 17 character payslip reference code.

What to do if you are finding it hard to pay your personal tax bill

If you find yourself in the situation where paying your personal tax bill in one “go” is difficult, the best approach is contact HMRC in plenty of time. As well as the basic details such as your reference number, the amount you owe and why you are finding it difficult to pay, they will also want to know what you’ve done to try and find the money you need. They’ll want to know how much you can pay now and how long you think you will need to pay the balance, so think this through carefully beforehand.

Ultimately, HMRC will decide what they think you can pay now, which may be the full amount or instalment payments over a period of time. They will ask you about your income, your expenses including those of your spouse if you are married, and what assets you have such as savings and investments. HMRC will do whatever they can reasonably do in order to realise the monies they are owed as quickly as possible.

The penalties

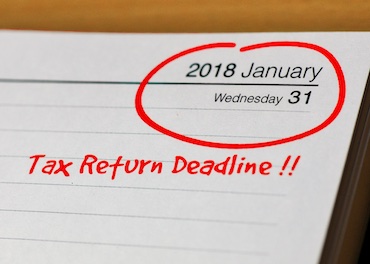

Overall, it’s better to tackle the problem well ahead of the 31 January deadline and to speak to HMRC to find a solution because penalties start to rack up immediately. They begin with interest charges from 1 February, which are then followed by a 5% surcharge after one month plus additional interest charges, and a further 5% surcharge if the liability remains outstanding another six months later.

All in all this is a blow, as a relatively easy and quick way of settling your income tax bill disappears for good.

Matthew Farrant

Partner

T: 01483 425724

E: mfarrant@hwca.com

Surrey offices in Godalming and Esher

www.hwca.com