Crowdfunding has revolutionised the alternative investment sector and its simplicity is quite seductive. Use the power of the crowd to fund great new businesses and projects. Although it may be fun to invest this way, do you really know what you are investing in? Rather than follow the crowd, isn’t it wiser to follow experienced investors? Shadow Foundr provides an investment platform that combines an active private investor network with a crowdfunding element. Two of the founders of the business, Jason Kluver and Heath Lansbury, explain to Ian Trevett how the model works.

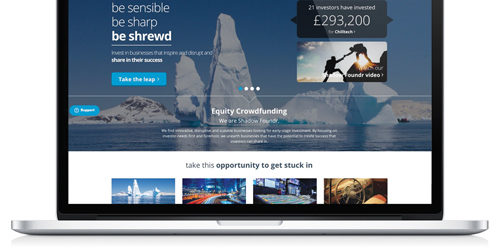

The Shadow Foundr website looks, to all intents and purposes, like a typical crowdfunding platform. You are invited to click on an image of an interesting, growing business, under which is a running total of how much has been invested, plus a percentage figure of how close the business is to reaching its target investment. But never suggest to Jason Kluver or Heath Lansbury that they have a crowdfunding company.

“We’re an investment platform,” corrects Jason, “and we have an offline network of almost 600 seasoned investors. We try and embrace crowdfunding and educate the crowd to invest smartly and wisely into these companies because a lot of the time we’re seeing the crowd just following the crowd, a bit like lemmings, and they’re not really understanding the basic fundamentals of investing into these start-ups.”

Heath adds, “We didn’t want to become a 100% crowdfunding platform because sometimes you can get too automated and in this industry you need to have an offline and an online presence.

“People don’t want to be putting £10,000 into a company without speaking to anyone. From our previous experience, we learnt that having an offline private investor network adds real value. Our strapline is: “Don’t just follow the crowd, follow the lead of experienced investors”.

“After we conduct our due diligence on an investment opportunity, we’ll put it to the private investor network first,” says Jason. “If they’re happy with it they’ll invest into it. Once we reach at least 30% of the investment target, we’ll put it on the platform for the crowd to follow, although in almost all cases the investor network will take far more than 30%.”

As the team at Shadow Foundr are seeking initial investment from experienced investors, they have to do their homework and due diligence. In fact, of all the businesses they look at, they typically only take on about 7%. With such a high bar, it is interesting to ask what Jason and Heath look for in a start-up or growing business.

Jason replies, “We’re not looking at business at too early a stage. Probably the first and foremost thing that we look for is the quality of the team involved. There are so many young people out there with great ideas for apps and gadgets but they don’t have any commercial experience to carry them through. We look for scalable opportunities. “Generally they’re in the tech and renewable sectors. We’re not looking for a coffee shop chain or craft brewery, although some of those have done very well. We’re looking for opportunities that can be scaled globally or that are truly disruptive.”

“You have a gut feeling,” says Heath. “Over time our radar has become very finely tuned and we can look at something and within five minutes we’ll know it’s just not for us. We know what our investors like. Renewable energies are attractive because of the government quotas and subsidies. The CleanTech sector is only going to get bigger, and there is a bit of a niche in renewables that can be reached because the banks generally won’t lend to companies in those early stages.”

In some ways the Shadow Foundr team could be compared to the panel on TV’s Dragon’s Den, with businesses looking for investment in exchange for equity - and always the thorny issue of how much the company is valued at. Some of the self-calculated valuations can be optimistic in the extreme. Heaths takes up the point, “If we don’t challenge the entrepreneur then we’re not doing our job. By the time it gets to our investors, they know that we’ve done our job. The valuation is the key in our sector. If you can’t justify your valuation then we can’t raise the money for you. We are very investor-focused and we get returns.”

On the other side, who exactly are the investors - and are there spaces for more?

Heath answers, “We’ve both worked in the investments sector for a long time and we have built up a good network of contacts. We know a lot of property investors from our last couple of ventures, and although the sector is different, the core principles are the same. We realised we needed to tap into that private money because the banks weren’t going to lend to the high-risk start-up sector. If we’re going to tap into private money we needed to educate people on tax breaks, covering both the upsides and downsides and that’s exactly what we’ve been doing. Over the last seven years, it’s been a reassuring and nurturing process.”

And they are on the lookout for new investors. Jason says, “To be part of the network there are criteria. You’ve got to be a high net worth individual with £250K of net liquid assets, or you should be certified or self-certified as a “sophisticated investor” as assessed by an FCA authorised firm as being sufficiently knowledgeable to understand the risks associated with engaging in investment activity. We also welcome people who have been a member of an Angel Group or an investment group.”

Over recent years, Shadow Foundr have begun to develop secondary markets on some of their chosen businesses, to allow more liquidity for the investors, though in most cases the investors tend to prefer to keep their investment. One example has been Chayora, which is one of only a very small number of international companies which holds the necessary licenses to build and operate data centres in China. Shadow Foundr have arranged four rounds of funding which have raised £2,153,056. The share price has increased from USD $160 to USD $2000. To allow investors to cash in, a secondary market was established, but of the 55 private investors, 45 opted to stay with the company as the investors believe it has a very bright future.”

So where next for Shadow Foundr? They have a team of 15 with offices in London, Brighton and Loughborough. Where will they be in five years? “Hopefully on a beach in Barbados!” says Heath. “We are building a brand not just in Brighton, Sussex and South East England but around the UK and eventually, globally.

www.shadowfoundr.com